Do you really know your financial position?

Your net worth is one of the most powerful indicators of financial health. More than your income, savings, or debt alone, net worth gives you a complete snapshot of where you stand — and how far you’ve come.

In this guide, you’ll learn:

- What personal net worth means

- How to calculate your net worth step by step

- Why tracking net worth is essential for financial success

- Tools and strategies to monitor your progress

- How to use net worth data to build wealth over time

Let’s dive in.

What Is Personal Net Worth?

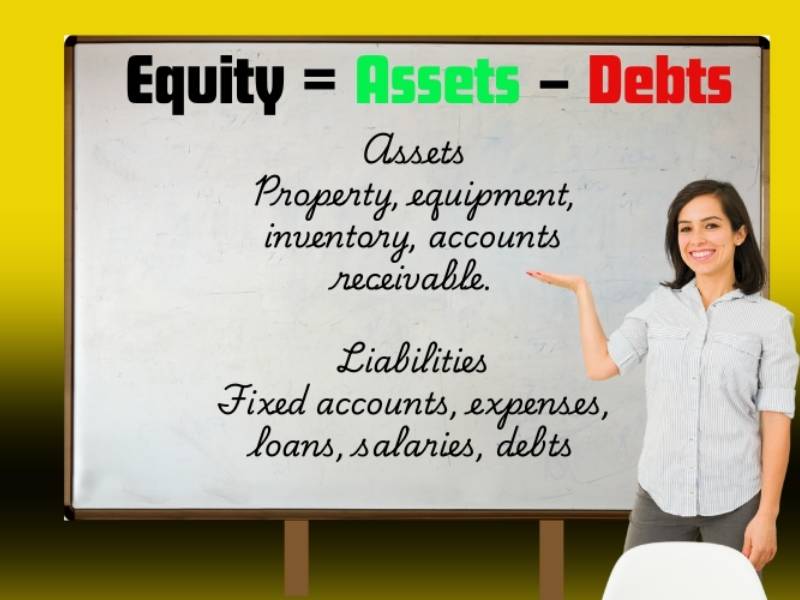

Your personal net worth is simply the difference between what you own (assets) and what you owe (liabilities).

Here’s the formula:

Net Worth = Total Assets – Total Liabilities

✅ If assets > liabilities → you have a positive net worth.

❌ If liabilities > assets → you have a negative net worth.

Examples of Assets

- Cash and savings accounts

- Investments (stocks, ETFs, crypto, retirement funds)

- Real estate and property

- Vehicles (owned or partially paid off)

- Valuables (jewelry, art, collectibles)

- Business ownership

Examples of Liabilities

- Credit card balances

- Student loans

- Car loans

- Personal loans

- Mortgage

- Medical debt

- Taxes owed

Your goal is simple: grow assets, reduce liabilities, and increase your net worth over time.

Why Tracking Net Worth Matters

Most people only look at income or their monthly budget, but these don’t show the full financial picture.

Personal net worth. Benefits of tracking net worth:

- Clear view of long-term financial health

- Helps you set realistic money goals

- Keeps you motivated to pay off debt and save

- Highlights progress over time

- Reveals whether you’re building wealth or just covering expenses

Net worth helps you answer:

“Am I moving forward financially, or staying stuck?”

How to Calculate Your Net Worth (Step by Step)

Let’s go through a simple example.

Step 1: List Your Assets

| Asset | Value |

|---|---|

| Checking account | $1,500 |

| Savings account | $3,000 |

| Retirement account | $12,000 |

| Investment account | $5,000 |

| Car (market value) | $7,000 |

| Total Assets | $28,500 |

Personal net worth. Use bank statements, investment accounts, and valuation tools like Kelley Blue Book for vehicles.

Step 2: List Your Liabilities

| Liability | Amount Owed |

|---|---|

| Credit card debt | $2,300 |

| Student loan | $8,500 |

| Car loan | $3,500 |

| Total Liabilities | $14,300 |

Be honest and complete. Hiding debts only hurts your financial clarity.

Step 3: Subtract Liabilities From Assets

$28,500 (assets) – $14,300 (liabilities) =

Net Worth: $14,200

That’s your current financial standing.

How Often Should You Track Net Worth?

- Monthly → if you’re aggressively paying debt or saving

- Quarterly → if your finances are stable and automated

Best tracking methods:

- Spreadsheets (Excel, Google Sheets)

- Apps like Personal Capital, YNAB, Monarch Money

- Manual notebooks if you prefer offline

Personal net worth. Pro tip: Use a net worth graph to visualize growth over time. This makes progress more motivating.

See also: Why Consistency in Investment Management Beats the Size of Your Contributions.

How to Use Net Worth Data Effectively

Personal net worth. Knowing your number is just the beginning.

1. Set Financial Goals

Example: “Increase net worth by $5,000 in 12 months.”

Break it down into actions:

- Save $300/month

- Pay down credit cards

- Invest an extra $100/month

2. Celebrate Milestones

- Reaching $0 net worth (from negative)

- Hitting your first $10K

- Doubling your previous record

3. Adjust Based on Results

- Too much debt? Prioritize repayments

- Assets not growing? Increase investments

- Spending too high? Review your budget leaks

4. Focus on Net Worth, Not Just Income

A high salary doesn’t guarantee wealth. Many high earners still have negative net worth due to overspending.

True financial freedom comes from growing assets faster than liabilities.

Net Worth and Life Stages

Personal net worth. Your financial journey changes with age.

In Your 20s

- Net worth may be negative (student loans)

- Build emergency savings

- Start investing early — even small amounts

In Your 30s–40s

- Pay off high-interest debt

- Increase retirement contributions

- Consider real estate or business investments

In Your 50s+

- Focus on asset protection

- Pay down remaining liabilities

- Optimize for retirement income

Remember: there’s no perfect net worth number. What matters is steady growth.

Tools to Help Track Net Worth

Not a fan of spreadsheets? Try:

- Personal Capital – investment & net worth tracker

- Mint – budgeting + net worth overview

- YNAB – goal-focused budgeting

- Monarch Money – holistic financial management

Personal net worth. Choose tools that reduce stress and add clarity.

Common Mistakes When Tracking Net Worth

Avoid these pitfalls:

- Ignoring liabilities (pretending debts don’t exist)

- Overvaluing assets (inflated car/home values)

- Only tracking once a year (not enough data)

- Comparing yourself to others (focus on your journey)

Final Thoughts: Know Where You Stand to Build Wealth

Calculating your personal net worth is not about comparing yourself to others — it’s about awareness, clarity, and empowerment.

See also: Understanding Investment Risk: A Smart Investor’s Guide to Managing Uncertainty.

When you know your number, you can:

- Set better goals

- Track meaningful progress

- Make smarter financial decisions

Take 30 minutes today.

Calculate your net worth.

Track it consistently.

Your net worth is more than just a number — it’s a compass to financial freedom.

FAQ – Calculating and Tracking Your Net Worth.

What is personal net worth?

Net worth is the total value of your assets minus your liabilities. It reflects your overall financial health and helps you understand whether you’re building wealth or falling into debt.

How do I calculate my net worth?

Add up all your assets (cash, investments, property, etc.) and subtract all your liabilities (credit cards, loans, mortgages). The formula is:

How often should I track my net worth?

Tracking monthly or quarterly is ideal. This allows you to monitor trends, adjust your financial plan, and celebrate progress without becoming overwhelmed by short-term fluctuations.

Why is net worth more important than income?

Why is net wortIncome shows how much money you earn, but net worth shows how much you actually keep and grow over time. It’s a more accurate reflection of your financial stability and wealth.h more important than income?

What should I do if I have a negative net worth?

A negative net worth isn’t uncommon, especially if you have student loans or recent debt. Focus on reducing liabilities, building assets gradually, and tracking progress to move into positive territory.