Getting a raise or landing a better-paying job feels great — and it should. But what often happens next is something known as lifestyle inflation: as your income increases, so do your expenses. Suddenly, you’re spending more without necessarily improving your long-term financial health.

In this guide, we’ll explore what lifestyle inflation is, how it sneaks up on you, and 7 proven strategies to resist the urge to overspend. By the end, you’ll have a clear plan to make your income work for you — not against you.

What Is Lifestyle Inflation?

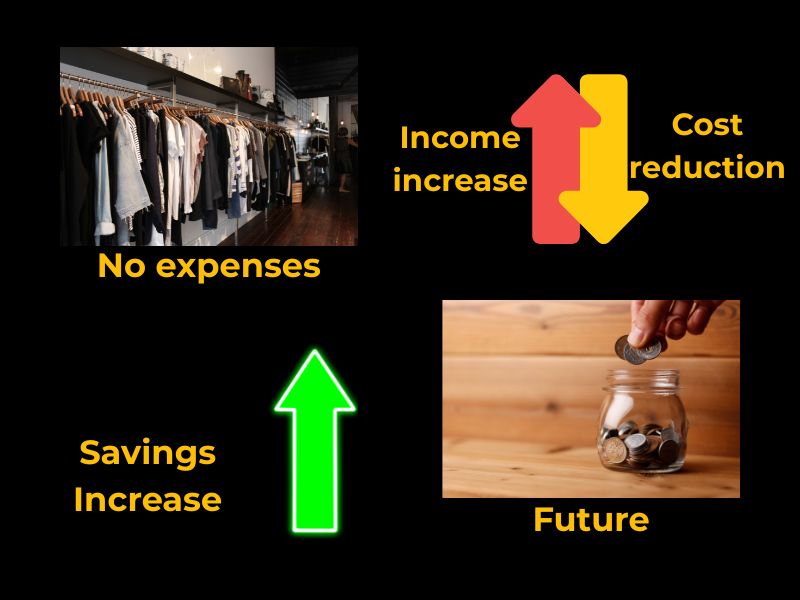

Lifestyle inflation (also called lifestyle creep) happens when your spending grows as quickly as, or even faster than, your income. Instead of using raises, bonuses, or extra income to save or invest, you direct it toward more consumption.

Examples include:

- Upgrading your car even though the old one works fine

- Moving into a larger apartment or house before you really need the space

- Eating out more frequently instead of sticking to your budget

- Subscribing to multiple streaming services you rarely use

- Buying luxury items simply because you can

While small upgrades can seem harmless, over time they erode your ability to save, invest, and achieve major milestones like homeownership, early retirement, or building generational wealth.

Why Lifestyle Inflation Happens

Understanding the triggers is the first step to fighting it. Here are the main causes:

1. Social Pressure

When friends, coworkers, or family members upgrade their lifestyles, you might feel the need to “keep up.” This is especially strong in work environments where status symbols — like cars, clothes, or gadgets — are highly visible.

2. Desire to Reward Yourself

You’ve worked hard, and it feels only fair to celebrate your success with something nice. While rewarding yourself is healthy, doing it excessively can turn a small treat into a financial setback.

3. Emotional Spending

Money becomes a tool to cope with stress, boredom, or insecurity. The instant gratification of purchases can temporarily mask deeper issues.

4. Lack of a Financial Plan

Without clear goals, you drift into spending by default. Raises or bonuses feel like “free money,” and instead of being allocated to savings, they’re absorbed into day-to-day expenses.

💡 According to a 2023 survey by Bankrate, 65% of Americans reported that their expenses rose as their income increased, proving just how common lifestyle creep is.

Signs You’re Experiencing Lifestyle Inflation

- You spend nearly all of every raise or bonus

- Your monthly expenses grow faster than your salary

- You’re not saving at least 20% of your income

- You often upgrade things “just because you can”

- You feel no significant improvement in financial stability, despite earning more

👉 If you recognize yourself in two or more of these signs, it’s time to take action.

7 Proven Strategies to Avoid Lifestyle Inflation

1. Create or Revisit Your Financial Goals

A raise or bonus should be a tool for progress, not just more spending power.

Steps to take:

- Write down your top 3 financial goals.

- Assign a specific dollar amount and timeline to each.

- Break goals into smaller milestones (e.g., “Save $5,000 in 12 months” instead of just “Save more”).

📌 Example: Instead of upgrading your car, direct your $500 monthly surplus toward a down payment fund for a home. Over two years, that’s $12,000 saved.

2. Automate Your Savings Increases

When you get a raise:

- Immediately boost your retirement contributions.

- Add more to your emergency fund.

- Set up an automatic transfer to a brokerage or savings account.

Consider the 50/50 rule: save half, enjoy half. That way, you celebrate your success while still building wealth.

💡 According to Fidelity, workers who automatically increase retirement contributions with raises end up retiring with 25–30% more savings compared to those who don’t.

3. Track Your Spending Closely

Awareness is powerful. Use budgeting apps like:

- YNAB (You Need a Budget) — great for hands-on budgeting

- Mint — easy overview of income vs. expenses

- Empower — track investments alongside spending

- Google Sheets/Excel — fully customizable

Look for red flags:

- Categories growing faster than your income

- Multiple subscriptions with overlapping benefits

- Frequent impulse purchases

Even reducing “hidden leaks” by $100–200 per month can grow into thousands when invested over time.

Also read: How to Review and Refresh Your Financial Plan 10 Ways Each Year for Lasting Success.

4. Define a “Good Life” on Your Own Terms

Ask yourself:

- What actually brings me happiness?

- Do I really need a bigger home, or just a more organized one?

- Would I prefer more things or more freedom?

📌 Studies show that experiences (travel, learning, quality time with loved ones) provide greater long-term happiness than material purchases.

Don’t let social media or advertising dictate your definition of success. Build your own version of the “good life.”

5. Practice Delayed Gratification

Impulse upgrades can sabotage savings. Lifestyle inflation. Instead:

- Apply the 30-day rule before big purchases

- Compare at least three alternatives

- Ask: “Does this align with my goals and values?”

Example: Instead of buying the latest iPhone at $1,200, wait 6–12 months. Prices drop, and in that same time you could invest the money, which may grow instead of depreciating.

6. Live Below Your Means — Even as Income Grows

This is the golden rule of building wealth. Commit to living on 70–80% of your income and invest the rest.

Benefits include:

- Larger safety net for emergencies

- Faster debt payoff

- More freedom to retire early or pursue passion projects

💡 Warren Buffett, despite being a billionaire, is famous for living in the same modest house he bought in 1958. That mindset of resisting lifestyle inflation is part of why his wealth multiplied.

7. Celebrate Without Overspending

Celebrating wins is important, but it doesn’t need to be extravagant.

Affordable ways to celebrate:

- A weekend road trip instead of a luxury vacation

- A special dinner at home with loved ones instead of fine dining every week

- Investing in an experience (like a course or hobby) that brings long-term joy

👉 Budget for fun intentionally — that way it’s guilt-free and doesn’t derail your savings goals.

The Snowball Effect of Saving Raises

Here’s how powerful this strategy can be:

- Earn $50,000/year and save 10% = $5,000

- Get a raise to $55,000. If you keep living on $50,000 and save the extra $5,000, you’re now saving 18% of your income.

- Continue this habit for 10–15 years, and your savings rate skyrockets without lifestyle sacrifices.

That’s the snowball effect — small, consistent choices that compound into massive results.

Action Plan: How to Start Today

- Write down your top 3 financial goals.

- Automate a savings increase with your next paycheck.

- Cancel 1 unnecessary subscription this week.

- Apply the 30-day rule to any purchase over $100.

- Review your budget monthly and adjust.

These small steps, taken consistently, build the foundation for long-term financial freedom.

Also read: 10 Proven Steps to Create a Personal Budget That Works.

Final Thoughts

Lifestyle inflation is subtle but powerful. Left unchecked, it can drain your wealth-building potential and keep you stuck in the paycheck-to-paycheck cycle — even at higher income levels.

But with awareness, intention, and a solid plan, you can resist the trap, enjoy your income increases, and build lasting financial independence.

👉 Your future self won’t thank you for the upgrades — but for the freedom you created by avoiding them.

FAQ – How to Avoid Lifestyle Inflation and Grow Your Savings Instead.

What is lifestyle inflation and why is it harmful?

Lifestyle inflation happens when your spending increases along with your income. While it may feel rewarding, it often prevents long-term wealth building and delays financial goals like retirement or homeownership.

What are signs that I’m experiencing lifestyle inflation?

Common signs include spending every raise or bonus, increasing monthly expenses faster than income, and upgrading things like cars or gadgets without real need. If you’re not saving at least 20% of your income, it’s a red flag.

How can I prevent lifestyle inflation after getting a raise?

Automate increases to your savings and retirement accounts as soon as your income rises. Following the 50/50 rule — save half, enjoy half — is a great way to grow wealth while still celebrating your progress.

Why is it important to define a “good life” on your own terms?

When you know what truly brings you happiness, you avoid unnecessary spending driven by social pressure or advertising. This helps you align your spending with your values, not just your income.

What’s the snowball effect of saving your raises?

By saving each raise instead of spending it, your savings rate increases without sacrificing your lifestyle. Over time, this accelerates your path to financial freedom.