Budgeting often gets a bad reputation. Many people hear the word “budget” and think about strict rules, no fun, and constant restriction. But in reality, a budget isn’t about saying “no” — it’s about saying yes to the things that truly matter. How to use a budget and control my finances.

When you learn how to use a budget to gain control of your finances, you create freedom. You stop wondering where your money went each month, and instead, you start telling your money where to go. With a clear plan, you can reduce stress, pay off debt faster, and build savings that support your long-term goals.

In this article, you’ll discover practical steps to create a budget that works, simple methods to track your spending, and tips to stay consistent. By the end, you’ll see why budgeting is one of the most powerful tools for achieving financial freedom.

What Is a Budget and Why Does It Matter?

How to use a budget and control my finances. A budget is simply a spending plan for your money. Instead of leaving your financial decisions to chance, a budget gives you structure and clarity.

With the right budget in place, you can:

- Track income and expenses with accuracy

- Avoid overspending and reduce unnecessary debt

- Save consistently for short- and long-term goals

- Make confident financial choices that align with your values

Think of a budget as your financial GPS. It tells you where you are and how to get where you want to go.

✅How to use a budget and control my finances. A good budget isn’t about cutting everything out — it’s about making sure your money reflects your priorities.

Step 1: Know Your Numbers

Before you can build a successful budget, you need a clear picture of your financial situation.

Start by writing down:

- Monthly income (after taxes)

- Fixed expenses (rent, utilities, subscriptions, insurance)

- Variable expenses (groceries, transportation, dining, entertainment)

- Debt payments (credit cards, student loans, car loans)

- Savings contributions (retirement, emergency fund, investments)

How to use a budget and control my finances. Tools to help:

- Bank and credit card statements

- Budgeting apps like YNAB, Mint, or EveryDollar

- A simple spreadsheet or notebook

✅ Awareness is power. Once you know your numbers, you’ll see where money leaks are happening — and where you can redirect funds.

Step 2: Choose the Right Budgeting Method

Not all budgets look the same. The key is to pick a system that matches your lifestyle and personality.

1. The 50/30/20 Rule

- 50% for needs (housing, bills, groceries)

- 30% for wants (dining, travel, hobbies)

- 20% for savings and debt repayment

This method is simple, flexible, and beginner-friendly.

2. Zero-Based Budget

Every dollar you earn is given a specific “job.” Your income minus your expenses equals zero. This approach ensures that no money is wasted.

3. The Envelope System

Popularized by financial expert Dave Ramsey, this system assigns cash (or digital envelopes) to categories. Once the envelope is empty, you stop spending in that category.

✅How to use a budget and control my finances. Experiment until you find a method that feels sustainable and effective for your goals.

Step 3: Set Clear Financial Priorities

Your budget should reflect what matters most. Without priorities, you risk spending on things that don’t move you closer to your goals. How to use a budget and control my finances.

How to use a budget and control my finances. Ask yourself:

- What are my top short-term goals (e.g., pay off a credit card, save for a vacation)?

- What are my long-term goals (e.g., buy a home, retire early, start a business)?

- Am I overspending in areas that don’t align with my values?

✅ Choose your top 1–3 financial priorities and make room for them in your budget. How to use a budget and control my finances.

See more: How to Use a Personal Finance Spreadsheet to Organize Your Money.

Step 4: Build Your Monthly Spending Plan

Once you know your income and priorities, it’s time to create a monthly plan.

- Start with your total income.

- Subtract fixed expenses.

- Allocate for variable expenses like groceries, gas, and dining.

- Add savings and debt repayment.

- Adjust until everything fits within your income.

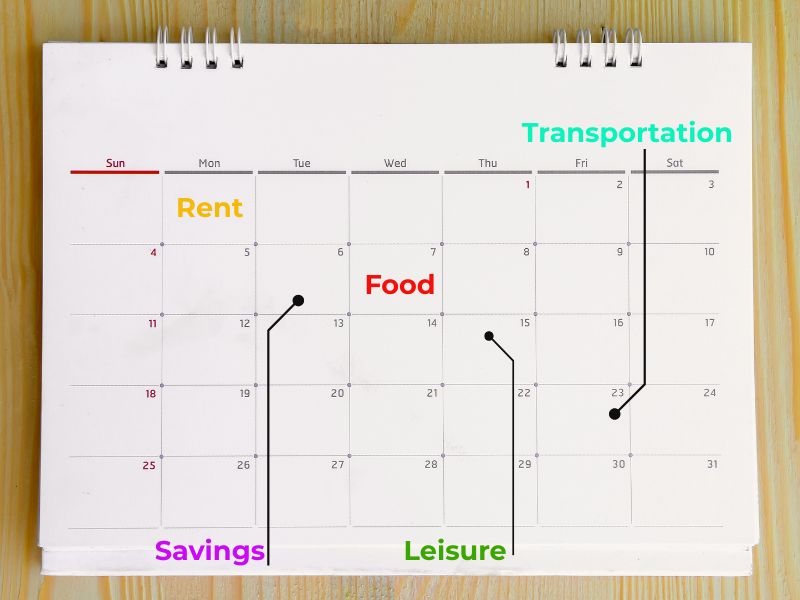

Tip: Use calendar-based budgeting to prepare for seasonal expenses like holidays, birthdays, or vacations.

✅ Planning ahead reduces last-minute stress and debt. How to use a budget and control my finances.

Step 5: Track and Review Your Spending Weekly

A budget only works if you actually use it. Checking in regularly helps you stay on track.

Options include:

- Reviewing bank and credit card activity weekly

- Using apps that categorize transactions automatically

- Keeping a small spending journal for accountability

✅ Weekly check-ins take only 15 minutes but can save you hundreds of dollars a month.

Step 6: Plan for Irregular and Unexpected Expenses

Many budgets fail because people forget about irregular costs. To avoid surprises, create sinking funds for:

- Car repairs and maintenance

- Medical expenses

- Annual subscriptions or memberships

- Gifts and holiday spending

- Emergency travel or home repairs

✅ Setting aside small amounts monthly prevents you from relying on credit cards when these expenses arise. How to use a budget and control my finances.

Step 7: Adjust and Improve Over Time

Your first budget won’t be perfect — and that’s okay. The key is consistency, not perfection.

- Review your budget monthly

- Adjust categories as your lifestyle changes

- Learn from mistakes instead of giving up

- Celebrate small wins (like paying off one debt or saving your first $1,000)

✅ Remember: a budget is a living document. It evolves as your life and goals evolve.

Bonus: Proven Tips for Budgeting Success

How to use a budget and control my finances. To make your budgeting journey easier, try these strategies:

- Automate savings and bill payments to avoid missed deadlines

- Use cash for categories where you overspend (like dining out)

- Give yourself a fun allowance to avoid burnout

- Share goals with a partner or accountability buddy

- Keep your goals visible (on your phone, planner, or mirror)

- Review progress quarterly and celebrate improvements

✅ Small tweaks make a huge difference over time.

How Budgeting Helps You Build Financial Freedom

When you use a budget effectively, you gain more than just numbers on a spreadsheet. You gain:

- Clarity about where your money goes

- Control over impulsive spending

- Confidence in your financial decisions

- Calmness knowing you’re prepared for emergencies

- Choices to invest, travel, or retire earlier

How to use a budget and control my finances. Budgeting isn’t punishment — it’s empowerment.

See more: How to Build and Maintain Good Financial Habits.

Final Thoughts: Take Control of Your Money Today

How to use a budget and control my finances. Learning how to use a budget to gain control of your finances is one of the smartest decisions you can make. With a clear plan, you can stop living paycheck to paycheck, reduce stress, and finally start moving toward financial independence.

Start small, stay flexible, and keep your goals in focus. Remember, every successful financial journey begins with a single step — and that step is creating a budget.

✅ Your money should serve your dreams, not the other way around. Take control today.

FAQ – How to Use a Budget to Gain Control of Your Finances.

How to use a budget and control my finances. What is the purpose of a budget?

A budget is a plan for how you spend your money. It gives you control, helps you reach goals, avoid debt, and make smarter financial decisions with confidence.

What are the most effective budgeting methods?

Popular methods include the 50/30/20 rule, zero-based budgeting, and the envelope system. Choose the one that best fits your lifestyle and spending habits.

How do I start building a monthly budget?

Begin by tracking your income, fixed expenses, and variable spending. Then assign each dollar a purpose — including savings and debt payments — and adjust to stay within your means.

Why is tracking expenses important?

Tracking spending helps you stay accountable and spot areas to adjust. Weekly check-ins or using budgeting apps can keep you on course and prevent overspending.

How can I improve my budget over time?

Review and adjust your budget monthly. Plan for irregular expenses, automate savings, and allow some fun money. Budgeting is a skill that gets better with practice and consistency.