Credit cards can be powerful financial tools — but if used carelessly, they can quickly turn into a source of overwhelming debt. While some people see credit cards as dangerous traps, others use them strategically to build credit, earn rewards, and enjoy financial convenience.

The real secret lies in knowing how to use credit cards without getting into debt. With discipline, awareness, and the right habits, you can turn credit into a tool that works for you instead of against you.

In this guide, we’ll explore practical steps, proven strategies, and common mistakes to avoid when managing your credit cards. Whether you’re new to credit or looking to improve your financial habits, these tips will help you stay debt-free and financially secure.

Why Use Credit Cards?

When used responsibly, credit cards provide significant advantages that cash or debit cards simply can’t match.

Here are the top benefits:

- Build your credit history and improve your credit score.

- Earn rewards such as cash back, points, or travel miles.

- Fraud protection and easier dispute process compared to debit cards.

- Track spending and manage cash flow more effectively.

- Emergency backup when unexpected expenses arise.

However, these benefits only matter if you avoid carrying a balance. The key is paying off your charges in full every month to eliminate interest and protect your finances.

The Hidden Danger of Credit Card Debt

Credit cards often come with interest rates between 18% and 25% APR. Carrying a balance for just a few months can cause a small expense to snowball into a long-term financial burden.

Example:

If you carry a $2,000 balance at 20% APR and only make minimum payments, it could take several years to pay off and cost you hundreds of dollars in interest.

This is why credit card debt is one of the most common financial pitfalls. It’s easy to swipe the card without thinking, but paying off the balance becomes increasingly difficult over time.

Rule #1: Pay Your Balance in Full Each Month

The most important rule of responsible credit card use is simple: always pay your balance in full.

When you pay your bill by the due date:

- You avoid all interest charges.

- Your credit score stays healthy.

- You enjoy the perks and rewards without added costs.

✅ Pro tip: Set up automatic payments or calendar reminders so you never miss a due date.

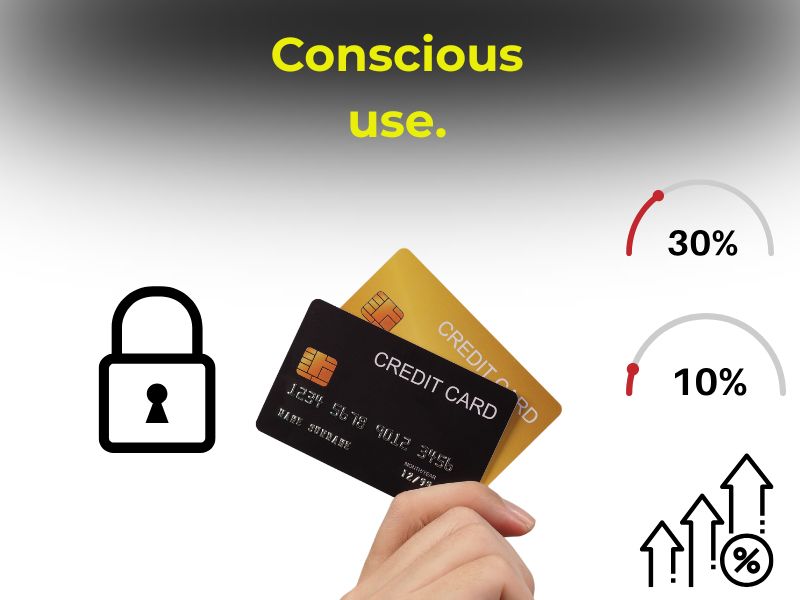

Rule #2: Keep Credit Utilization Below 30%

Your credit utilization ratio — the percentage of credit you use compared to your limit — plays a major role in your credit score.

- Stay below 30% of your credit limit at all times.

- For the best results, keep it under 10%.

Example:

If your credit limit is $5,000, avoid carrying more than $1,500 at any point during your billing cycle.

✅ Pay your balance multiple times a month if necessary to keep your utilization low.

Rule #3: Only Use Credit for Budgeted Purchases

Think of your credit card as a debit card with rewards. Only spend money you already have in your budget.

Avoid using your card for:

- Impulse shopping

- Covering budget shortfalls

- Emotional or stress spending

✅ If you wouldn’t pay cash for it today, don’t charge it to your card.

Rule #4: Choose the Right Credit Card

Not all credit cards are created equal. The best card for you depends on your spending habits and financial goals.

- Cash back cards → Best for everyday spending.

- Travel cards → Ideal for frequent travelers.

- Balance transfer cards → Useful for consolidating and paying off high-interest debt.

- Secured cards → Designed for building or rebuilding credit.

When comparing options, consider:

- Annual fees

- Rewards structure

- Introductory APR offers

- Foreign transaction fees

✅ Use tools like NerdWallet, Bankrate, or Credit Karma to compare cards.

Rule #5: Track Spending and Review Statements

Regularly reviewing your statements helps you spot problems early.

Check your credit card bills for:

- Unauthorized charges

- Subscription renewals you no longer need

- Spending patterns that may need adjusting

✅ Use budgeting apps like Mint, YNAB, or PocketGuard to track your credit card spending in real time.

Also read: Credit Score Explained: How It Works and How to Use It Wisely.

Rule #6: Set Limits and Controls

Most credit card companies allow you to customize spending controls.

You can:

- Set alerts for large purchases.

- Lock your card temporarily if it’s lost.

- Limit online or international transactions.

✅ These tools are especially useful if you’re new to credit or managing a shared account.

Rule #7: Avoid Cash Advances and Late Payments

Two of the fastest ways to get into debt are cash advances and late payments.

- Cash advances have higher interest rates, no grace period, and extra fees.

- Late payments damage your credit score and may trigger penalty APRs.

✅ Even if you can only afford the minimum, pay it on time — but aim to pay the full balance whenever possible.

Rule #8: Maximize Rewards Without Overspending

Rewards are a great perk of using credit cards responsibly — but they should never justify overspending.

Use your rewards wisely by redeeming them for:

- Statement credits

- Flights, hotels, and travel perks

- Gift cards or merchandise (but compare value first)

✅ Choose a card that matches your everyday spending (e.g., groceries, gas, or online shopping) to maximize benefits without extra costs.

Rule #9: Have a Debt Repayment Plan (Just in Case)

Even with the best intentions, life happens. If you ever find yourself carrying a balance, create a clear repayment strategy.

Popular methods include:

- Debt Avalanche → Pay off the card with the highest interest first.

- Debt Snowball → Pay off the smallest balance first for motivation.

✅ Use balance transfer offers carefully — only if you’re confident you can pay off the debt before the promotional period ends.

Rule #10: Build a Positive Relationship With Credit

Credit cards are more than spending tools; they’re stepping stones to financial independence. When used wisely, they can help you:

- Qualify for better loans and mortgages.

- Secure lower interest rates.

- Increase your overall financial flexibility.

The key is remembering that credit is a tool, not free money.

Final Thoughts: Use Credit Cards With Discipline

Credit cards aren’t inherently good or bad — it all comes down to how you use them. By paying balances in full, keeping utilization low, avoiding impulsive purchases, and using rewards strategically, you’ll enjoy all the benefits of credit cards without falling into debt.

Action steps to remember:

- Always pay in full.

- Stay below 30% utilization.

- Stick to your budget.

- Track spending regularly.

- Avoid cash advances.

- Use rewards wisely.

Treat credit with respect, and you’ll build a strong financial foundation that supports your long-term goals.

Also read: How to Protect Financial Data Online and Prevent Identity Theft in 2025.

FAQ – How to Use Credit Cards Without Getting Into Debt.

What’s the best way to avoid credit card debt?

Always pay your full balance by the due date. This avoids interest charges, protects your credit score, and lets you enjoy rewards without the cost of carrying debt

How much of my credit limit should I use?

Keep your credit utilization below 30% — and ideally under 10% — of your credit limit. This helps boost your credit score and shows lenders you manage credit responsibly.

What should I use my credit card for?

Only use your card for planned, budgeted expenses you can afford to pay off immediately. Avoid using it for impulse purchases, emergencies, or to cover a lack of cash.

How do I choose the right credit card?

Pick a card that aligns with your goals and spending habits — such as cash back, travel rewards, or balance transfers. Compare fees, perks, and interest rates before applying.

Why is it important to review my statements regularly?

Checking your statements helps you spot fraud, track spending habits, and stay on budget. Use alerts and apps to monitor usage and stay in control.